With only a couple of months of available inventory and homes selling in a median of three weeks, it’s no surprise that home prices are continuing to rise across the country. In fact, home prices have continuously risen for the last 9 years, since February 2012. The median existing-home price rose to $310,800 in November; 15% more than a year earlier; 41% more than five years earlier.

Home prices definitely vary widely by area. You may have heard this mantra before: “Location, location, location.” Indeed, as data shows, homes can vary in value due to their location. Among 3,120 counties, nearly 60% of them had a median home price lower than $150K, and 37% of them had a home value in the range of $150K – $350K as of Q3 2020. However, the value of the typical home surpassed $1 million in the following five counties:

- San Mateo County, CA – $1.18 million

- San Francisco County, CA – $1.16 million

- New York County, NY – $1.15 million

- Santa Clara County, CA – $1.13 million

- Nantucket County, MA – $1.06 million

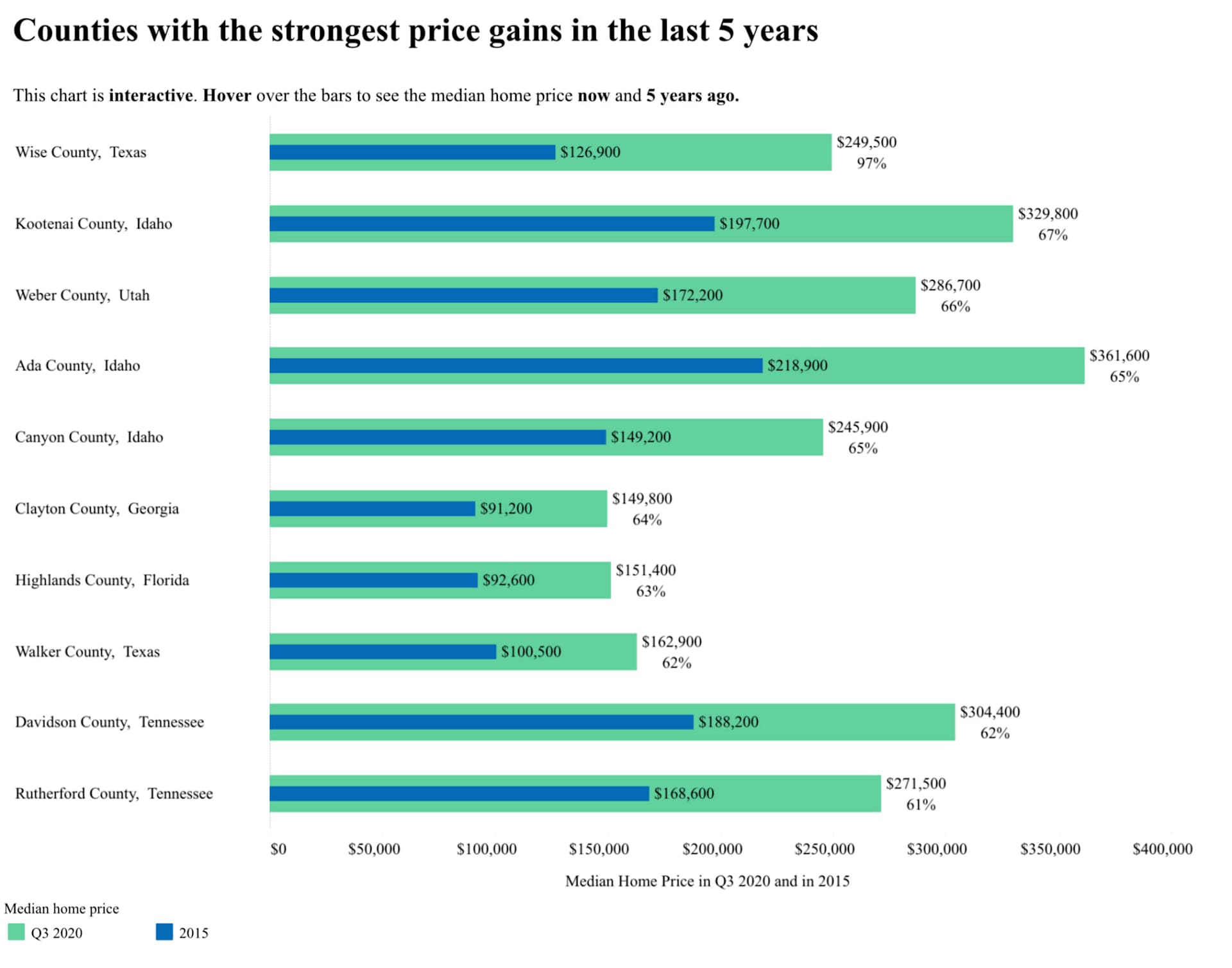

Meanwhile, the following counties experienced the strongest price gains in the last 5 years. Specifically, in the following counties1, home prices rose more than 60% since 2015. For instance, in Wise County, Texas, the median home price rose to $250,000 in the 3rd quarter of 2020 from $130,000 in 2015.

With housing demand even stronger during the pandemic, NAR is forecasting home prices to rise further by 5% in 2021.

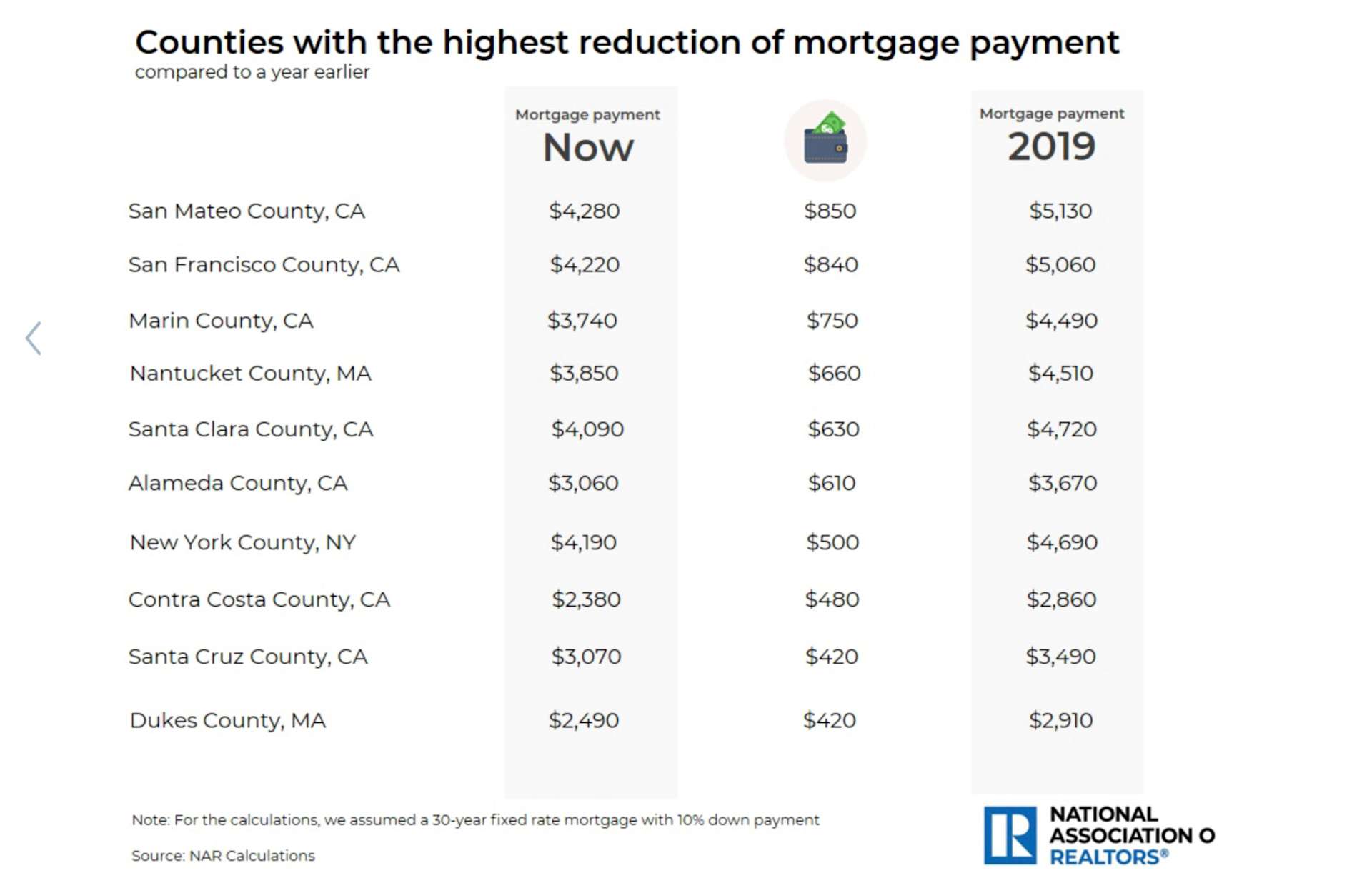

However, mortgage rates – another important determinant of mortgage payments – have significantly declined. In fact, mortgage rates have dropped more than 1 percentage point within a year. Specifically, the 30-year fixed rate was 3.73% at the end of 2019 compared to 2.67% at the end of 2020. For instance, the monthly payment for a mortgage of $400,000 drops by $230 due to these lower rates. However, since home prices are rising, current and soon-to-be homebuyers may need to get a bigger mortgage to buy their home. After comparing the monthly mortgage payment now with that of a year earlier, housing is still more affordable in most of the counties. For instance, the monthly payment for the typical home in San Mateo County, CA is $4,280 in Q3 2020 compared to $5,130 a year earlier. Nevertheless, if home prices continue to rise at this pace, many would-be homebuyers will be priced out of the market.

The counties below had the highest reduction in the monthly mortgage payment due to the lower mortgage rates compared to a year earlier. Keep in mind that the impact of lower rates is higher in large mortgages.